Fintech, short for financial technology, has revolutionized the way payments are made in today’s digital age. Gone are the days when making a payment involved physically handing over cash or writing checks. With the advent of fintech, payments have become as simple as pushing a button on our smartphones or computers. While this may seem like a seamless process from the user’s perspective, there’s a lot more going on behind the scenes to ensure the smooth flow of funds.

The Role of Big Data in the Fintech Industry

One key element that plays a significant role in the fintech industry is big data. Big data refers to the vast amounts of information generated from various sources, such as financial transactions, customer behavior, and market trends. Fintech companies leverage this data to gain insights and make informed decisions to enhance their products and services.

By harnessing the power of big data analytics, fintech companies can analyze patterns and trends in customer behavior. This allows them to tailor their offerings to meet the specific needs and preferences of their target audience. Whether it’s personalized financial advice, customized investment options, or tailored lending solutions, big data empowers fintech companies to deliver a more personalized and optimized experience to their customers.

Streamlining the Payment Process

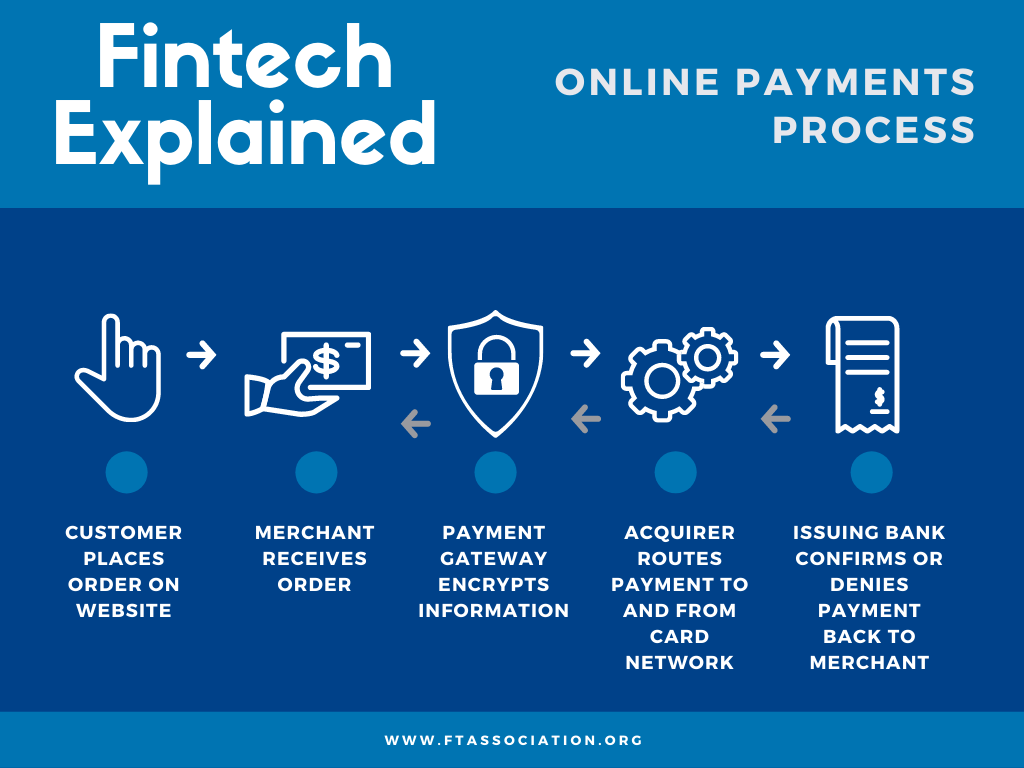

One of the main areas where fintech has had a significant impact is in streamlining the payment process. Traditional payment methods often involved manual intervention and multiple intermediaries, leading to delays and additional costs. Fintech has disrupted this paradigm by introducing seamless and efficient payment solutions that leverage technology and automation.

With the help of advanced algorithms and machine learning capabilities, fintech companies can detect anomalies and mitigate risks associated with fraudulent transactions. Real-time monitoring and adaptive fraud detection systems improve the security and reliability of online payments, ensuring a seamless and trustworthy experience for consumers.

Fintech innovations have also paved the way for alternative payment methods beyond traditional banking. Cryptocurrencies, mobile wallets, and peer-to-peer payment platforms have gained popularity, offering consumers more flexibility and convenience. These digital payment solutions enable faster and hassle-free transactions, eliminating the need for physical cash or bank visits.

In conclusion, fintech has transformed the world of payments by harnessing big data and leveraging technology to facilitate seamless and secure transactions. The industry’s ability to analyze vast amounts of data provides valuable insights, allowing fintech companies to deliver personalized and optimized experiences. As technology continues to advance, we can expect further advancements and disruptions in the fintech space, ultimately benefitting both businesses and consumers alike.