Fintech is an ever-evolving industry that presents both challenges and opportunities for companies. As technology continues to advance, the financial technology sector is experiencing significant growth and transformation. In this post, we will explore some of the key challenges and opportunities that Fintech companies are currently facing.

Fintech Challenges:

One of the major challenges faced by Fintech companies is regulatory compliance. As Fintech services involve handling sensitive customer data and transactions, they must adhere to strict regulatory requirements to ensure data security and privacy. This often requires significant investment in compliance measures and staying up-to-date with changing regulations.

Another challenge in the Fintech industry is the increasing competition. With the rise of digital banking, mobile payment apps, and alternative lending platforms, the market has become saturated with numerous players. Fintech companies need to differentiate themselves by offering unique and innovative solutions to stand out from the competition.

Additionally, cybersecurity is a major concern for Fintech companies. As they handle large amounts of financial data, they are attractive targets for cybercriminals. It is crucial for Fintech companies to invest in robust cybersecurity measures to protect their systems and customer data.

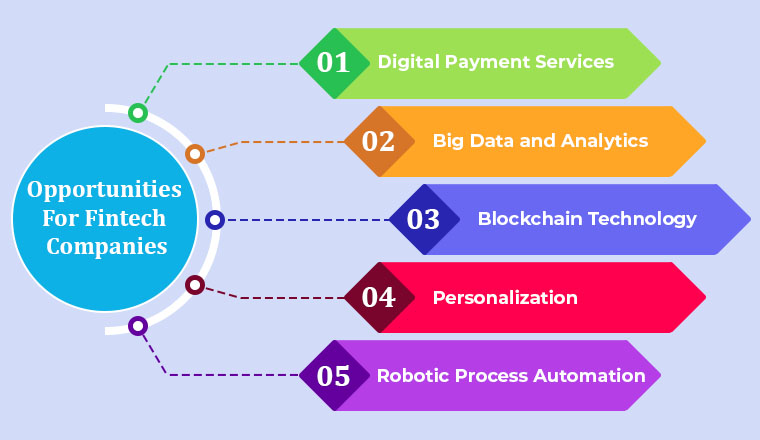

Fintech Opportunities:

Despite the challenges, Fintech companies also have numerous opportunities to capitalize on. One such opportunity is financial inclusion. Fintech has the potential to broaden access to financial services for populations that are currently underserved by traditional banks. By leveraging technology, Fintech companies can reach remote areas and provide banking services to the unbanked and underbanked populations.

Another significant opportunity for Fintech companies is the adoption of artificial intelligence (AI) and machine learning (ML). These technologies can analyze vast amounts of data to derive valuable insights and improve decision-making processes. By integrating AI and ML into their platforms, Fintech companies can enhance fraud detection, risk assessment, and customer experience.

The advent of open banking is also creating opportunities for Fintech companies. Open banking allows customers to share their financial data securely with authorized third-party providers through APIs. This enables Fintech companies to access customer data from multiple financial institutions, allowing them to offer more personalized and tailored services.

In conclusion, the Fintech industry is a dynamic and rapidly evolving sector that presents both challenges and opportunities. Regulatory compliance, competition, and cybersecurity are significant challenges that Fintech companies must address. However, opportunities for financial inclusion, AI and ML adoption, and open banking offer immense potential for growth and innovation within the industry. As technology continues to advance, Fintech companies must stay agile and embrace these opportunities to stay ahead in the ever-changing landscape of financial technology.